Although incoming money is essential to business expansion, more is needed to provide the complete picture of your company’s financial health. You need to know your company’s profitability when business expenses are subtracted. It would be best if you ascertained the net income of your company. You may evaluate your company’s profitability, choose whether to increase or decrease activities, create budgets, and communicate information to investors by calculating your net income. But how do you compute net income for a merchandiser?

Although incoming money is essential to business expansion, more is needed to provide the complete picture of your company’s financial health. You need to know your company’s profitability when business expenses are subtracted. It would be best if you ascertained the net income of your company. You may evaluate your company’s profitability, choose whether to increase or decrease activities, create budgets, and communicate information to investors by calculating your net income. But how do you compute net income for a merchandiser?

In this article, we will help you find out what net income is, how to calculate it, and which financial statement you will use to record it.

Also read: How to Start Selling Digital Products on Shopify

What is Net Income?

Net income is the number of profits left over after all business costs have been paid. Net income may also be termed net earnings, net profit, or the bottom line of your business.

Either a positive or negative net income is possible. You will have a positive amount of net income if your sales outweigh your costs—a net loss results from having a negative net income, often known as expenses exceeding receipts.

Operating expenditures, payroll expenses, rent, utilities, taxes, interest, some dividends, and other fees are business expenses you might incur. You can obtain net income on an annual, quarterly, or monthly. You can Pick a time period that works for your company. Also, you need to know your company’s gross income and expenses for the period to calculate net income.

What is the Difference Between Net Income and Gross Income?

So what exactly is gross income? Gross income which is also known as gross profit, is the amount your company has before deducting expenses, in contrast to net income. To determine your net income, you will use gross income.

You need to know the entire revenue and cost of goods sold for your company to calculate gross income. The revenue you have after deducting your cost of goods sold is your company’s gross income). The cost of goods sold (termed as COGS) is the cost of producing a good or providing a service.

How to Compute Net Income?

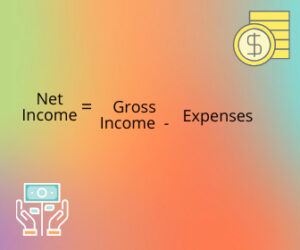

Now that we have a clear view of what net income and gross income are, let’s study how you compute net income for a merchandiser. By deducting the cost of goods sold and expenses from the overall revenue of your company, you may determine net income.

It would help if you comprehended the formula for calculating gross income before you can calculate net income:

Look at the net income formula now:

Alternatively, you can determine net income by using the following formula below:

Net Income = Gross Income – Cost of Goods Sold – Expenses

You might also like: Best Mockup Generators in 2023 – Printful

Example of How to Compute Net Income

Let’s imagine you’re looking for your business’s net income for June. Here are some details

Total Earnings of $40,000.

Cost of goods sold $20,000

Expenses:

Rent: $3,000

Utilities: $600

Spending: $1000

Salary: $4000

Taxes: $800

Find out your company’s gross income first. From your overall revenue, deduct the cost of the goods sold.

$40,000 – $22,000 = Gross Income

$40,000 – $20,000 = $20,000

Add up all of your monthly expenses next (not including the cost of goods sold). Your expenses come to $9,400 after adding rent, utilities, spending, salary, and tax costs. Get your net income by deducting all your expenses from your gross income.

Net income = $20,000 – $9,400

Net Income = $10,600

$10,600 is your net income for the period.

What is Income Statement?

In your company’s income statement, you record the net income. Businesses utilize three primary financial statements, one of which is the income statement.

Your company’s profitability is displayed on an income statement. It lists the gains and losses your company experienced during a specified time frame. Net income calculation is shown in income statements.

The income statement includes lines for total revenues, the cost of goods sold, gross income, costs, taxes, and net income. Because net income appears as the last line of the statement, it is sometimes referred to as the bottom line.

Multi-Step Income Statement for Merchandising Business

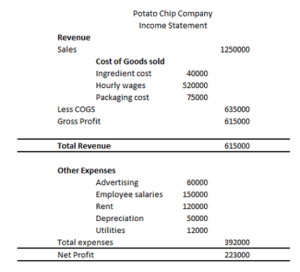

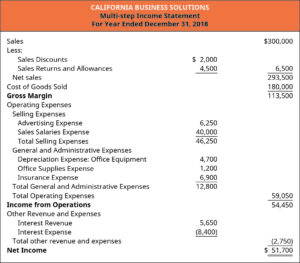

For a merchandising business, the multi-step income statement is utilized to track revenue and expense activities. It is an improved single-step income statement that is more comprehensive.

The cost of purchasing the inventory sold is the most significant expense a goods organization faces. Comparing an item’s purchase price to its final selling price is vital. This relationship can be easily observed thanks to the multi-step income statement’s presentation of financial data.

Here is a sample income statement for a retail store. At the top of the sheet, you’ll see that an expenditure account called Cost of Goods Sold links up with net sales.

The multi-step income statement for a merchandiser includes three computed amounts: net sales, gross profit, and net income.

The actual revenue a business generates is known as net sales. It shows all the sales that “went out the door,” less all the returns and discounts that were issued.

- Net Sales = Sales – Sales Returns – Sales Discounts

Gross profit, sometimes known as “markup,” is the disparity between the price a business pays for a good and the price it charges a consumer.

- Gross Profit = Net Sales – Cost of Merchandise Sold

Net income is the company’s profit after all costs are deducted from net sales.

- Net Income = Gross Profit – Operating Expenses

You might also like: How to Build Shopify App (Step by Step Guide)

Conclusion

Businesses must understand how do you compute net income for a merchandiser. Any link between the revenues and costs of merchandising companies is significant because it connects to a broad indicator of business profitability. For instance, a business may generate a high gross margin on sales. Yet, due to increased sales expenses, the owner might only be able to pocket a relatively small portion of the gross margin as profit.